Designed to meet the needs of an increasingly complex financial landscape, Scottish Widows Platform is built on state-of-the-art technology, leveraging innovative tools and easy to use online access to provide you with a user-friendly and intuitive experience.

From automated processes to seamless integrations with back-office software and tools, our platform is designed to work with you to help grow your business and allow you to focus on providing great outcomes to your clients.

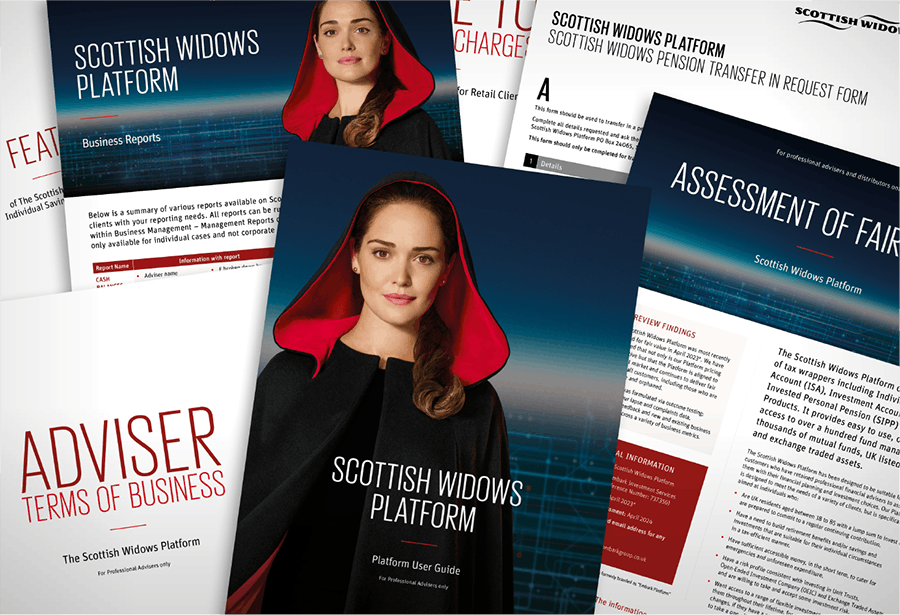

We provide access to over a hundred fund managers and thousands of mutual funds, UK listed Stocks & Shares and Exchange Traded Assets. We also offer a wide range of tax wrappers including ISAs and Pensions.